Calculate percentage of tax from paycheck

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Tax Witheld Calc Shop 58 Off Www Wtashows Com

The wage bracket method and the percentage method.

. Divide this number by the gross pay. 10 12 22 24 32 35 and 37. For example if an employee earns 1500.

Get the Paycheck Tools your competitors are already using - Start Now. Calculate Federal Income Tax FIT Withholding Amount. Sign Up Today And Join The Team.

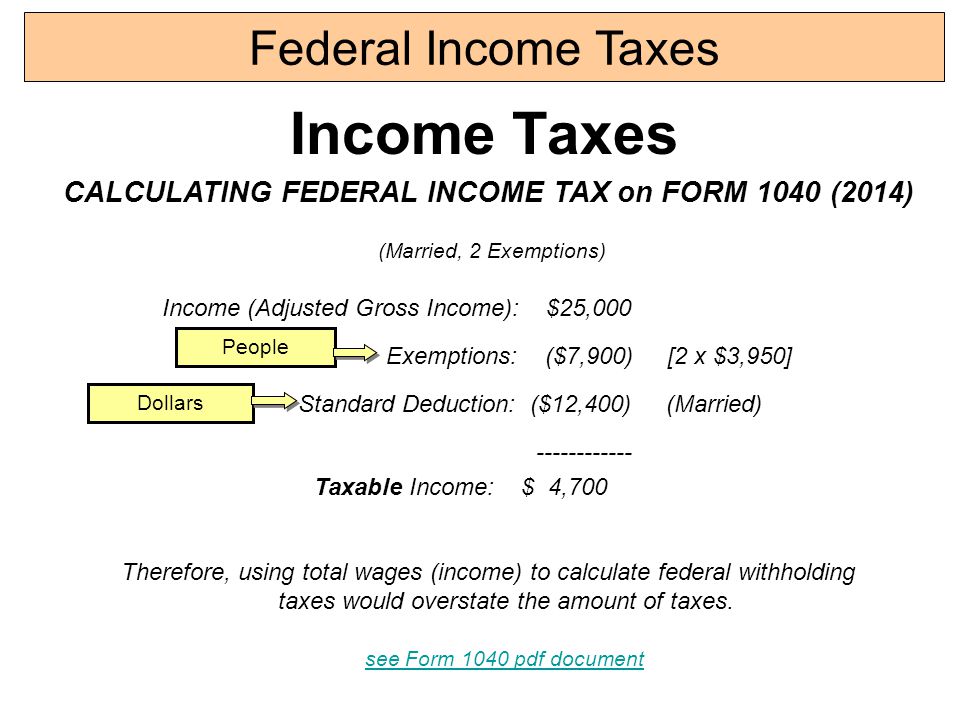

To calculate Federal Income Tax withholding you will need. There is a wage base limit on this tax. Your bracket depends on your taxable income and filing status.

This is divided up so that both employer and employee pay 62 each. The current tax rate for social security is 62 for the employer and 62 for the employee or 124. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. The employees adjusted gross pay for the pay. What is the percentage that is taken out of a paycheck.

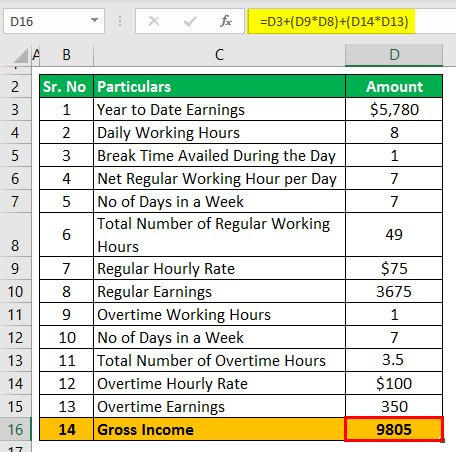

Percent of income to taxes About This Answer. Federal Bonus Tax Percent Calculator. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

How do I calculate hourly rate. The maximum an employee will pay in 2022 is 911400. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Ad Compare and Find the Best Paycheck Software in the Industry. FICA taxes are commonly called the payroll tax. Ad Payroll So Easy You Can Set It Up Run It Yourself.

For the 2019 tax year the maximum. However they dont include all taxes related to payroll. What percentage of taxes are taken out of payroll.

Get Started Today with 2 Months Free. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Simplify Your Day-to-Day With The Best Payroll Services.

Current FICA tax rates. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Learn About Payroll Tax Systems.

FICA taxes consist of Social Security and Medicare taxes. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Next divide this number from the. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Sign Up Today And Join The Team. Current FICA tax rates. The current tax rate for social security is 62 for the employer and 62 for the employee or.

Social Security tax. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. These are the rates for.

Get Your Quote Today with SurePayroll. If your state does. How to calculate annual income.

There are seven federal tax brackets for the 2021 tax year. All Services Backed by Tax Guarantee. Learn About Payroll Tax Systems.

There are two main methods small businesses can use to calculate federal withholding tax.

How To Calculate Taxes On Paycheck Deals 58 Off Www Ingeniovirtual Com

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

How To Calculate Payroll Taxes Taxes And Percentages

Margin Calculator Omni Calculator Omni Calculators

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Awesome Salary Calculator Salary Calculator Salary Calculator

Dutch Tax Calculator

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Use The Online Margin Calculator To Find Out The Selling Price The Cost Or The Margin Percentage Itself How To Find Out Calculator Calculators

How To Calculate Payroll Taxes Methods Examples More

Aicpa Offers Loan Forgiveness Calculator For Paycheck Protection Program The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

Biweekly Budget Template Paycheck Budget Budget Printable Etsy Budget Spreadsheet Budgeting Weekly Budget

How To Calculate Taxable Income H R Block

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Taxes On Paycheck Deals 58 Off Www Ingeniovirtual Com